The Post Office Monthly Income Scheme (MIS) is a government-backed investment plan designed to provide a reliable and steady monthly income for individuals across India. It allows investors to deposit a lump-sum amount, which then earns interest that is credited monthly. This makes the MIS particularly popular among retirees, homemakers, and salaried individuals looking for predictable financial returns without exposure to market volatility.

The scheme is considered one of the safest investment options, as it is fully guaranteed by the Government of India. Unlike equities or mutual funds, which are subject to market fluctuations, the principal and interest under MIS remain secure, ensuring peace of mind for conservative investors. Additionally, the scheme can be an excellent tool for financial planning, enabling families to manage recurring expenses through a predictable income stream.

Current Interest Rate — What Investors Should Know

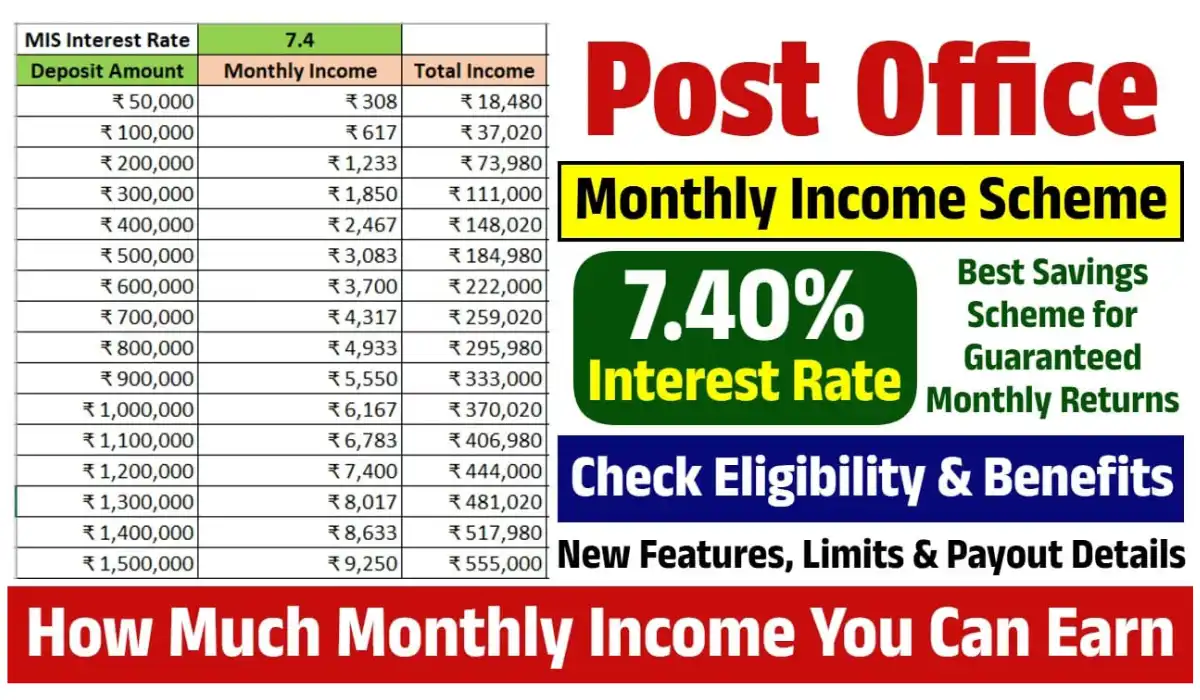

As of 2026, the interest rate for MIS is set at 7.40% per annum, and it is credited to investors monthly. This rate is relatively stable compared to other small-savings schemes, reflecting a balance between government fiscal policy and market conditions.

Investors can expect steady returns over the entire tenure of the scheme, and the monthly crediting of interest helps in better financial management, as the income can be used directly for household expenses, medical bills, or reinvestment. Historically, the MIS interest rate has undergone minor revisions depending on government securities yields, but the consistent rate provides predictability, making it ideal for long-term income planning.

How to Calculate Monthly Returns — MIS Calculator Explained

The calculation of monthly income from MIS is straightforward, as it uses simple interest. The formula is:

Monthly Interest = (Investment Amount × Annual Interest Rate) / 12

For example, with the current 7.40% p.a.:

- An investment of ₹100,000 yields about ₹6,166 per month in income.

- An investment of ₹500,000 provides roughly ₹30,833 per month, which can serve as a significant supplement to household income or retirement funds.

- For a larger investment of ₹900,000, monthly income would be around ₹55,500, offering a strong recurring cash flow for long-term planning.

This calculation demonstrates the ease of understanding returns under MIS, which is particularly appealing for retirees and conservative investors who prefer clarity and predictability in their finances. Unlike compounded schemes, MIS’s monthly simple interest ensures that the amount received each month is consistent and easy to plan around.

Investment Limits & Account Types

MIS has defined investment thresholds to ensure that individuals and families can manage risk while still generating meaningful income.

- Single account holders can invest up to ₹9,00,000. This limit ensures that even small-scale investors can participate while maintaining control over maximum exposure.

- Joint accounts, which can include up to three adults, allow a combined investment of ₹15,00,000, making it suitable for families who want to pool savings for higher returns.

- The minimum investment starts at just ₹1,000, offering accessibility for small investors and students looking to start saving systematically.

Joint accounts can also serve as an effective financial planning tool for families, enabling shared income while maximizing the total returns within permissible limits. The scheme’s flexibility makes it suitable for both individual and collective investment strategies.

Features & Benefits — Why Many Indians Prefer MIS

The Post Office MIS offers several compelling advantages for investors seeking low-risk income. First, it guarantees monthly returns, which provides peace of mind, particularly for senior citizens or retirees relying on fixed income. Second, the scheme is transferable, so if an investor relocates, the account can be shifted to another post office without disrupting payments.

Additionally, MIS allows opening accounts for minors above the age of 10, with a guardian managing the account until the child reaches adulthood. This feature allows parents to create a financial cushion for their children while teaching them about long-term savings. Overall, the scheme is simple, low-risk, and universally accessible, making it a preferred option for long-term financial security.

Key Highlights at a Glance

| Feature | Details (2026) |

|---|---|

| Annual Interest Rate | 7.40% per annum |

| Interest Payment Frequency | Monthly |

| Monthly Return on ₹1,00,000 | ~ ₹6,166 |

| Maximum Investment (Single Account) | ₹9,00,000 |

| Maximum Investment (Joint Account) | ₹15,00,000 (total across joint holders) |

| Minimum Deposit | ₹1,000 |

| Tenure / Lock-in Period | 5 years |

| Eligibility | Indian residents; minors via guardianship |

| Taxation | Interest is taxable under income tax slab |

| Account Transfer | Allowed within India post offices |

Who Is Eligible — Your Checklist Before Applying

Eligibility for MIS is straightforward, which makes the scheme widely accessible. Only resident Indian citizens can open an MIS account. Non-resident Indians (NRIs) are ineligible. Investors must provide standard identification, such as Aadhaar, PAN, passport, or voter ID, along with proof of address and passport-sized photographs.

Minors aged 10 or above can have accounts opened under guardianship, allowing families to invest for children’s future needs. The scheme can be opened individually or jointly (up to three adults), providing flexibility for various family and financial structures. This simplicity in eligibility requirements ensures that MIS is inclusive and easy to access, making it a highly practical option for a broad range of Indian households.

Step‑by-Step: How to Apply for MIS

The MIS application process is designed to be simple and efficient. To open an account, you must visit a post office branch that offers savings accounts or MIS services. Fill out the prescribed application form, providing valid identity and address proof, along with photographs.

Once the form is submitted, deposit the desired investment amount, keeping within the minimum and maximum limits. For minors, provide guardian details. Investors are encouraged to designate a nominee to ensure smooth transfer of funds in case of unforeseen circumstances. After processing, the account becomes active, and the monthly interest is credited automatically to the linked savings account. The investment remains locked for a 5-year term, providing predictable income throughout.

Advantages & Limitations — What to Keep in Mind

Advantages

- Guaranteed Safety: Fully backed by the Government of India, offering extremely low default risk.

- Predictable Monthly Income: Ideal for retirees, homemakers, and salaried individuals seeking steady cash flow.

- Accessibility: Available at virtually all post offices in India.

- Flexible Account Options: Single, joint, and minor accounts provide adaptability for families.

- Ease of Planning: Simple interest payments allow accurate forecasting of monthly finances.

Limitations

- Simple Interest Only: No compounding means overall returns are lower compared to some other small-savings schemes.

- Moderate Returns: Other post office schemes or market-linked instruments may offer higher yields.

- Lock-in Period: 5-year tenure with penalties for premature withdrawal can limit liquidity.

- Taxable Interest: All interest is subject to income tax, potentially reducing net returns for high-slab investors.

Is MIS Still a Smart Choice in 2026?

MIS continues to be a highly suitable investment for risk-averse individuals seeking stable income without exposure to market volatility. With an annual interest rate of 7.40% credited monthly, investors can plan household budgets, retirement income, or recurring family expenses with confidence.

While MIS may not provide the highest returns compared to equities or mutual funds, its principal security, guaranteed monthly payouts, and accessibility make it an important part of any fixed-income investment strategy. By including MIS alongside other savings instruments, investors can balance safety, stability, and long-term growth in their financial portfolio.

Frequently Asked Questions (FAQs)

Q1. Can I open more than one MIS account under my name?

Yes, you can open multiple MIS accounts. However, the combined investment across all accounts under your name cannot exceed ₹9,00,000. This ensures that investments remain within the scheme’s stipulated limits while allowing flexibility in managing multiple accounts.

Q2. Is the interest on MIS compounded?

No, MIS offers simple interest. Monthly interest is calculated based on the principal amount and the annual rate. This ensures that every month’s interest remains consistent, providing predictable monthly income without additional compounding effects.

Q3. Can I withdraw my MIS investment before the 5-year maturity?

Early withdrawals are allowed, usually after completing one year of investment, but they are subject to penalties. The penalty is typically a percentage of the principal and varies depending on when the withdrawal occurs, which helps maintain the scheme’s integrity while providing some flexibility.

Q4. Is the interest earned from MIS taxable?

Yes, all interest received from MIS is taxable under the investor’s income tax slab. There is no automatic TDS deduction at the source for small amounts, so it is the responsibility of the investor to declare the interest income in their annual tax return.